-

» Who are we ?

The result of our skills which bring together knowledge of the European road transport industry and expertise in the methods necessary to the proper performance of its activity, in 2007 our company opened in the Grand Duchy of Luxembourg, a veritable crossroads both in terms of transport and economy within the heart of Europe, and has continued to develop its partnership thanks to the trust placed in us by our customers.

A young and dynamic company, J2B CONSULTANTS provides administrative services to international road transport professionals and all other businesses whose activities give rise to costs in the European Union.

These services consist in performing the formalities required for the refund of the various taxes paid out abroad to the Administrations of the concerned countries (V.A.T. and excise duties) pursuant to European tax law.

Since the transition to the "paperless" age of these formalities since January 1, 2010, our services have been adapted to the new electronic procedure for the reimbursement of V.A.T. pursuant to European Directive 2008/9/EC of February 12, 2008. For this purpose, starting in 2009, J2B CONSULTANTS has contributed to the orientation of companies and informing them of the transition to this new system.

Our goal was evidently to enable our customers to adapt to and be part of the paperless age, and we actively continue to develop this transition in the various countries of the European community.

For J2B CONSULTANTS, the quality of its relations with its customers is a priority. An integral part of our values, we meet each company we deal with, or which wishes to commission us, in order to understand its requirements, its objectives, and to present adapted solutions to it.

The core values of J2B CONSULTANTS are trust, flexibility and professionalism.

Our mission is your satisfaction.

-

» General Informations

Internationally active companies, based in the EU or in other foreign countries, are often required to perform various commercial operations abroad such as the payment of fuel, road tolls, meals or accommodation, and also various items of equipment within the framework of your activity.

It is entirely possible to exercise your right to the refund of taxes on some of these operations, according to the country in which you have made your purchases.

With its expertise in the field of the recovery of taxes paid within the European Union, J2B provide you with assistance in this often difficult task, which is rendered complex due to linguistic barriers, by handling your requests of V.A.T. refund and also T.I.C.P.E. (domestic duty on energy products) formerly T.I.P.P. (domestic duty on petroleum products) and other European excise duties.

From the implementation of the electronic procedures necessary to process certain requests to the follow-up and traceability of your files with the various tax administrations, we take great care in providing you with support for all your formalities until each of the missions you have entrusted to us is completed.

Aware of the impact of certain debts for companies, our company endeavours to have your taxes refunded to you as quickly as possible, and in the best conditions.

Providing you with the best assistance is one of our priorities. Proximity and adaptability are the driving forces of our company.

J2B offers you its services in complete transparency, and adds value through responsiveness.

» Our differents services

-

1

Refund of excise duties

The duty on petroleum products now represents a considerable portion of the expenses incurred for petrol by international road transport companies. With this in mind, J2B offers you a made-to-measure, clear and detailed service, enabling the refund of these duties, pursuant to the laws in force in the different countries. The procedures in this field require a high degree of accuracy. The competent Administrations to which ...

-

2

V.A.T. refund

One of our aims is to provide you with a V.A.T. refund service for your purchases made abroad, which is reliable and authentic, the sole purpose of which is to enable you to exercise your right to deduction in the best conditions before the European tax Administrations. In an economic context where we see an increase in the normal V.A.T. rates in certain countries ...

-

3

Electronic services

Apart from processing requests of V.A.T. refund, J2B also assists you, if you so request, in the implementation of the electronic means necessary to transmit your files to the European tax Administrations. The transition to the “paperless” age of V.A.T. refund requires professionals to hold electronic company ID cards known as electronic certificates which are recognised by the tax Administrations ...

-

-

Refund of excise duties V.A.T. refund Electronic services

The duty on petroleum products now represents a considerable portion of the expenses incurred for petrol by international road transport companies.

With this in mind, J2B offers you a made-to-measure, clear and detailed service, enabling the refund of these duties, pursuant to the laws in force in the different countries.

The procedures in this field require a high degree of accuracy. The competent Administrations to which these refund requests are transmitted pay particular attention to the constitution of files.

This is why J2B takes great care with respect to the quality of their presentation, both in terms of form and content. You provide us with your documents, and we will take care of the rest.

» Excise duties in Belgium

Are you a road transport company which circulates in Belgium in vehicles of 7.5 tonnes or more? Do you regularly refuel your vehicles? It is entirely possible to claim the refund of excise duties paid in Belgium.

This is a partial refund, the rate of which fluctuates according to periods which are defined according to the variations in the price of crude oil by the Belgium Customs during the course of a given year.

Refund requests are made on a monthly, quarterly or yearly basis depending on the volumes concerned.

In addition, the applicant must hold a permit "products Energy and Electricity - end user" during the period which he claimed the refund.

A few figures:

Average refund amount per period:

- Since 04/01/23: 205,06 €/m3

» The French T.I.C.P.E. (duty on energy products)

T.I.P.P. (duty on petroleum products) became T.I.C.P.E. (duty on energy products) in 2011, thereby clarifying its application to new energies as an excise duty.

Reviewed annually by the customs Administration, a flat rate fixes the partial refund of the duty to international road transporters registered in one of the countries of the European Union. This concerns vehicles of a total weight of 7.5 tonnes or more having purchased and consumed petrol in France.

Refund requests are made per quarter since 2020 (previously per semester) and can be realized until December 31st of the second year which follows the period of refund.

A few figures:

Refund flat amount per period:

- 1st quarter 2023: 157,10 €/m3

- 2nd quarter 2023: 157,10 €/m3

- 3rd quarter 2023: 157,10 €/m3

» Excise duties in Slovenia

Excise duties in Slovenia are partially reimbursable and refund requests may be made on a monthly, quarterly or annual basis, according to your requirements.

These requests are to be presented to the competent Administration before March 31 of the year following the reimbursement period.

A few figures :

Average refund amount per period:

- 01/23 to 09/23: 203,90 €/m3

» Excise duties in Spain

Spanish tax rules allow the partial refund of taxes on professional petrol sales, on the condition that the purchases have been made via "certain commercial diesel fuel cards". .

However, given the size of the file to be prepared and the fixed costs incurred, thank you to contact us.

These services are independent from our other services and do not in any event oblige professionals to subscribe to these other services to benefit from them.

Please contact us for more information on these procedures and our conditions. -

Refund of excise duties V.A.T. refund Electronic services

Created in France in 1954, V.A.T., a direct tax, has been increasingly adopted throughout Europe and has become one of the leading tax incomes of the Member States of the European Union.

The free circulation of individuals and goods has promoted intercommunity exchanges, in particular between professionals.

One of our aims is to provide you with a V.A.T. refund service for your purchases made abroad, which is reliable and authentic, the sole purpose of which is to enable you to exercise your right to deduction in the best conditions before the European tax Administrations.

In an economic context where we see an increase in the normal V.A.T. rates in certain countries, it is crucial that you have an investment return which is attractive and competitive, for optimal profitability.

Normal V.A.T. rates in the European Community

(Hover over one of the countries of the European Union to find its normal V.A.T. rate)

- Austria: 20 %

- Belgium: 21%

- Bulgaria: 20 %

- Cyprus: 19 %

- Czech Republic: 21 %

- Denmark: 25 %

- Estonia: 20 %

- France: 20 %

- Finland: 24 %

- Germany: 19 %

- Greece: 24 %

- Hungary: 27 %

- Ireland: 23 %

- Italy: 22 %

- Latvia: 21 %

- Lithuania: 21 %

- Luxembourg: 16 %

- Malta: 18 %

- Netherlands: 21 %

- Poland: 23 %

- Portugal: 23 %

- Romania: 19 %

- Slovakia: 20 %

- Slovenia: 22 %

- Spain: 21 %

- Sweden: 25 %

- United-Kingdom: 20 %

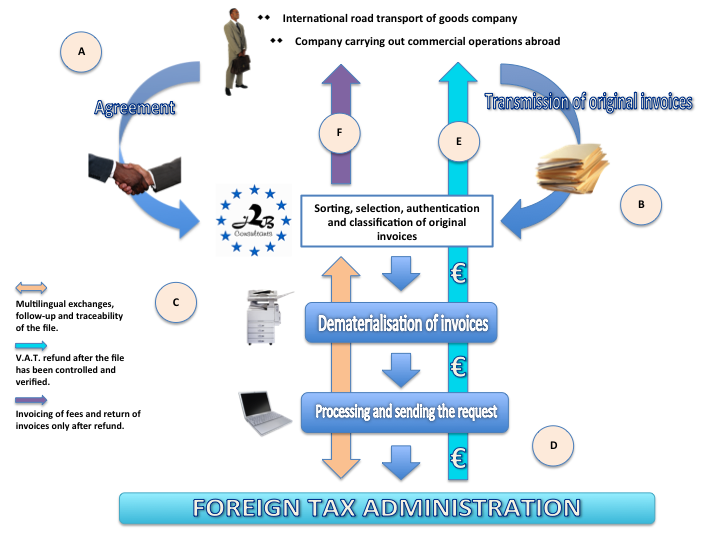

» V.A.T. refund for European companies

European laws concerning the intercommunity reimbursement of V.A.T. requires a detailed, periodical presentation for each refund request and also a deadline for filing requests fixed at September 30 of the year following the refund period pursuant to European Directive 2008/9/EC which has been in force since January 1, 2010.

J2B handles your requests on a quarterly, half-yearly or yearly basis according to your requirements and the specific criteria of each of the countries of the Union, while complying with the lower limits of validation of V.A.T. amounts to be reimbursed per period, for all suppliers.

Refund requests are established electronically from the Member State in which the customer is domiciled.

Upon receipt of a request, the tax Administration of the Member State of reimbursement has a period of 4 months in which to respond.

Conditions sine qua none to claim reimbursement of V.A.T.:

- You must have a V.A.T. number which is valid in the company's Member State

- You must not have an establishment in the Member State in which the refund is requested

- You must present original and detailed invoices bearing the V.A.T. number and address of the supplier, as well as your V.A.T. number and address in your capacity as customer.Typical procedure for a request of V.A.T. refund

Our fees are only invoiced after the V.A.T. refund for each formality performed.

Your interest is therefore our interest.J2B endeavours to implement all means to ensure that efficiency is the corner stone of our activity.

Please contact us for further information on this service.

» V.A.T. refund for non-EU companies

Is your company domiciled outside of the European Union zone? J2B can offer you a service which is adapted to your requirements.

According to the 13th European Directive, taxpayers who are not established in the European Union may claim the refund of V.A.T. paid in a Member State of the European Union.

The sole condition: you do not make deliveries of goods or provide services in such Member State.

As, in this case, the procedure for the V.A.T. refund differs from the one in force for EU companies, please contact us using the contact form provided so we can study your individual case and offer you an adapted service.

-

Refund of excise duties V.A.T. refund Electronic services

Apart from processing requests of V.A.T. refund, J2B also assists you, if you so request, in the implementation of the electronic means necessary to transmit your files to the European tax Administrations.

The transition to the “paperless” age of V.A.T. refund requires professionals to hold electronic company ID cards known as electronic certificates which are recognised by the tax Administrations so that each company in a given country can be registered electronically, which is now obligatory in order to be reimbursed any V.A.T. paid abroad.

Veritable online company passports enabling you to sign electronic documents, it is thanks to these certificates that it is now no longer necessary to provide the tax Administrations with taxpayer certificates, which certify your V.A.T. registration, but also in application of European Directive 2008/9/EC of February 12, 2008 which has been in force since January 1, 2010.

» Our objectives

1 - According to the country in which your company is established, J2B intervenes on your behalf before the bodies which distribute electronic certificates by performing the necessary formalities which are often complex and which have to be carried out in a language which you may not be familiar with.

2 - Furthermore, when you wish to commission J2B, you may do so in writing but, with this new system, you must also do so electronically.

With this in mind, J2B also offers you its assistance by facilitating these online operations which require great accuracy.3 - Since April 1st, 2016, a mileage tax exists in Belgium. Aware of the administrative tasks that it can cause, J2B can bring you its online solutions to establish your requests of V.A.T. refunds.

If you would like more information,

please leave your contact details and your question(s) in the "Contact" section of our website. -

» Practical Information

> Check the validity of your V.A.T. number or those of your suppliers or customers on the European Commission's Internet site.

Site : http://ec.europa.eu/taxation_customs/vies/?locale=en> Lkw-Maut: discover the map showing the additional road network taxed in Germany since August 1, 2012.

> Simplify your formalities by ordering your Eurovignettes directly online.

Site: https://www.eurovignettes.eu/portal/en/welcome> If you would like to know the fuel prices practiced in Luxembourg in real time ?

Please visit: https://belgique.carbu.com/index.php/luxembourg> Find all the necessary informations about the mileage tax in Belgium on the websites of the companies Satellic and Viapass :

- https://www.satellic.be/en-UK

- http://www.viapass.be/en/ -

-

» Legal notice

Editor: Benjamin BINOT

The site you are visiting provides information about J2B CONSULTANTS SARL.

All material on this website is governed by Luxembourg and international legislation on copyright and intellectual property. All reproduction rights are reserved, including for images and photographic elements.

The creation of hypertext links to this website is subject to the prior agreement of the Editor.

J2B CONSULTANTS

J2B CONSULTANTS S.A.R.L.

12 avenue de la Gare L-4873 LAMADELAINE

TVA LU 21818041 - RCS Luxembourg n°B127773 - Autorisation n°119741

Website creation, hosting, maintenance and referencing

AID TECHNOLOGIE

Web agency in France and LuxembourgE-mail: contact@aidtech.fr

> Link to our website : www.aidtech.fr